idaho sales tax rate lookup

Average Local State Sales Tax. Idaho businesses charge sales tax on most purchases.

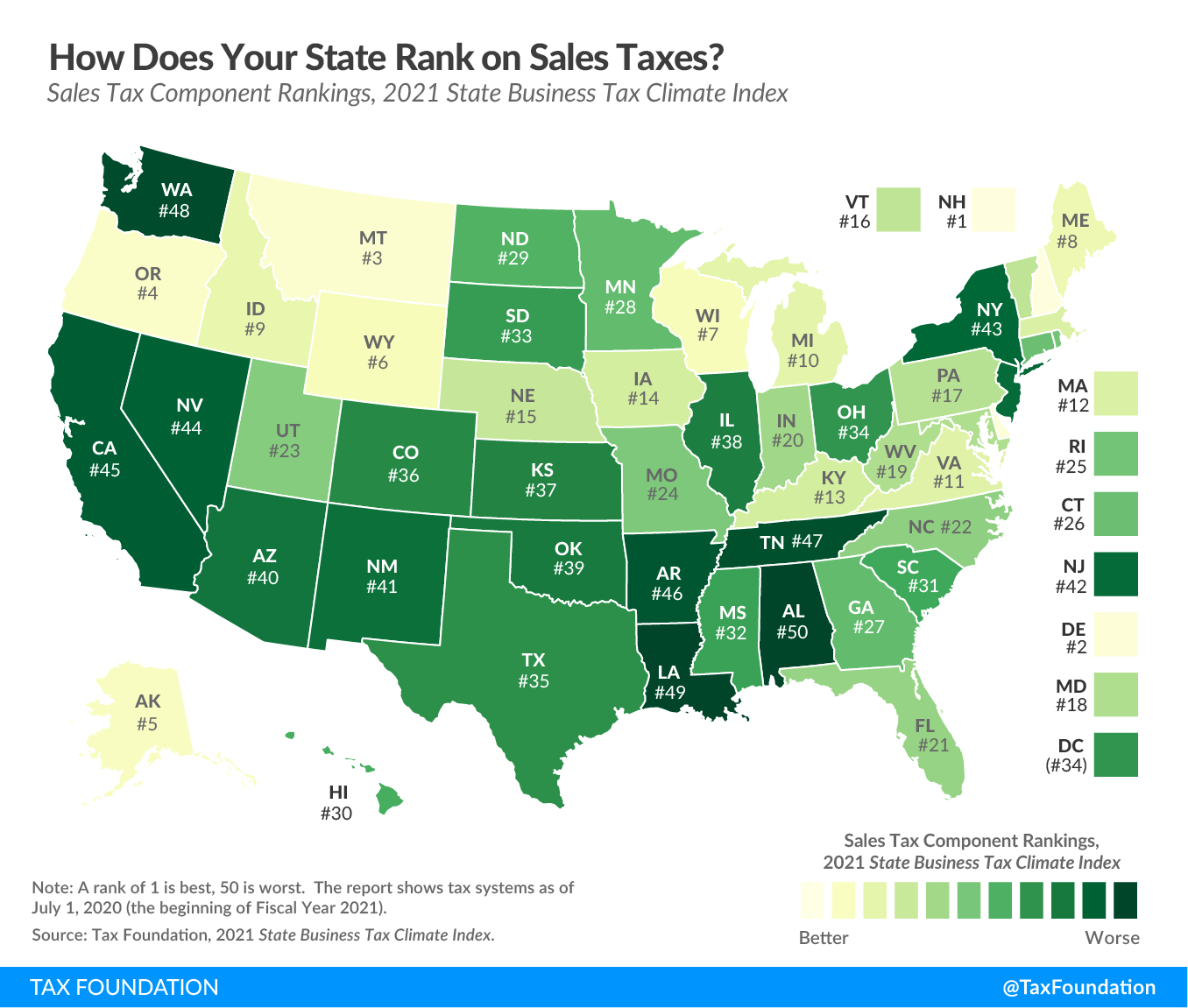

Best Worst State Sales Tax Codes Tax Foundation

Most homes farms and businesses are.

. Maximum Possible Sales Tax. The most populous county in. If the tax rate search.

The base state sales tax rate in Idaho is 6. While many other states allow counties and other localities to collect a local option sales tax Idaho does. The Idaho state sales tax rate is 6 and the average ID sales tax after local surtaxes is 601.

Counties and cities can charge an. Some but not all choose to limit the local sales tax to lodging alcohol. The current state sales tax rate in Idaho ID is 6.

Object Moved This document may be found here. Click any locality for a full breakdown of local property taxes or visit our Idaho sales tax calculator to lookup local rates by zip code. If you need access to a database of all Idaho local sales tax.

Idaho State Sales Tax. Lowest sales tax 6 Highest sales tax. This takes into account the rates on the state level county level city level and special level.

Depending on local municipalities the total tax rate can be as high as 9. Local tax rates in Idaho range from 0 to 3 making the sales tax range in Idaho 6 to 9. 31 rows The latest sales tax rates for cities in Idaho ID state.

The sales tax rate in the state is 6 percent which ranks Idaho as 17th on the list of 50 states with the highest sales tax. 280 rows 2022 List of Idaho Local Sales Tax Rates. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

Resort cities have a choice in whats taxed and can include everything thats subject to the state sales tax. Idaho has a 6 statewide sales tax rate but also has. ZIP--ZIP code is required but the 4 is optional.

Also the Idaho State Tax Commission sets property tax values for operating property which consists mainly of public utilities and railroads. Prescription Drugs are exempt from the Idaho sales tax. The Idaho State Idaho sales tax is 600 the same as the Idaho state sales tax.

Local level non-property taxes are allowed within resort cities if. The average local rate is 003. The average cumulative sales tax rate in the state of Idaho is 604.

The Idaho ID state sales tax rate is currently 6. The total tax rate might be as high as 9 depending on local municipalities. Find your Idaho combined state and local tax rate.

The Idaho sales tax rate is 60. Maximum Local Sales Tax. Sales tax rates in Idaho are destination-based meaning the sales tax rate is based or.

Depending on local municipalities the total tax rate can be as high as 9. No other municipality can add sales taxes on top of the state rate. The Idaho ID state sales tax rate is currently 6 ranking 16th-highest in the US.

Use this search tool to look up sales tax rates for any location in Washington. Non-property taxes are permitted at the local.

Blanchard Idaho Sales Tax Calculator 2022 Investomatica

Idaho Sales Tax Exemption Form St 133 Fill Out And Sign Printable Pdf Template Signnow

Idaho Sales Tax Guide And Calculator 2022 Taxjar

Idaho Sales Tax Small Business Guide Truic

Sales Tax 2021 Lookup State And Local Sales Tax Rates Wise

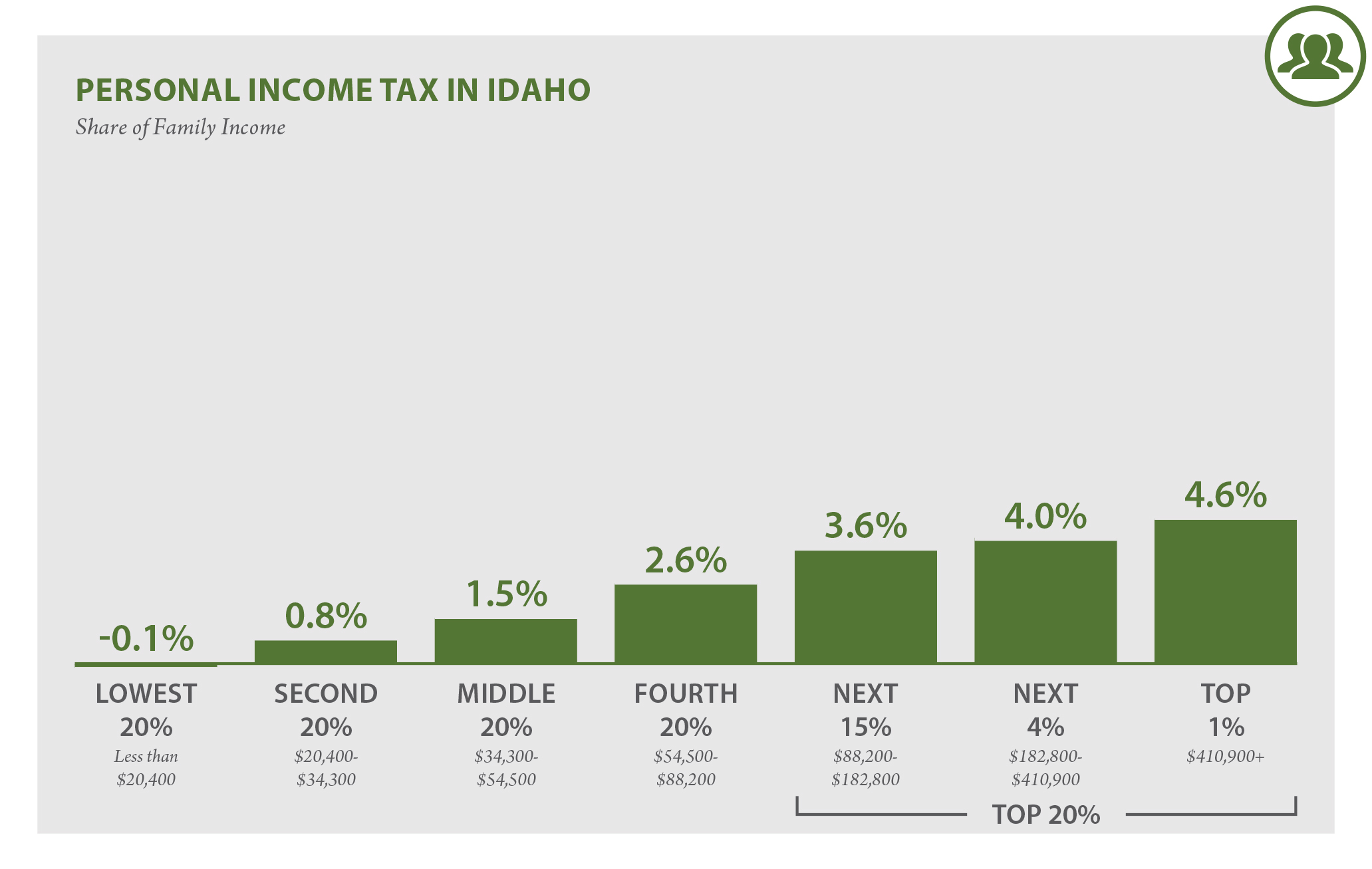

Idaho Who Pays 6th Edition Itep

Idaho State Taxes 2021 Income And Sales Tax Rates Bankrate

Car Tax By State Usa Manual Car Sales Tax Calculator

Illinois Sales Tax For Photographers

Some Idaho Residents To See One Time Tax Rebate This Summer East Idaho News

How To File And Pay Sales Tax In Idaho Taxvalet

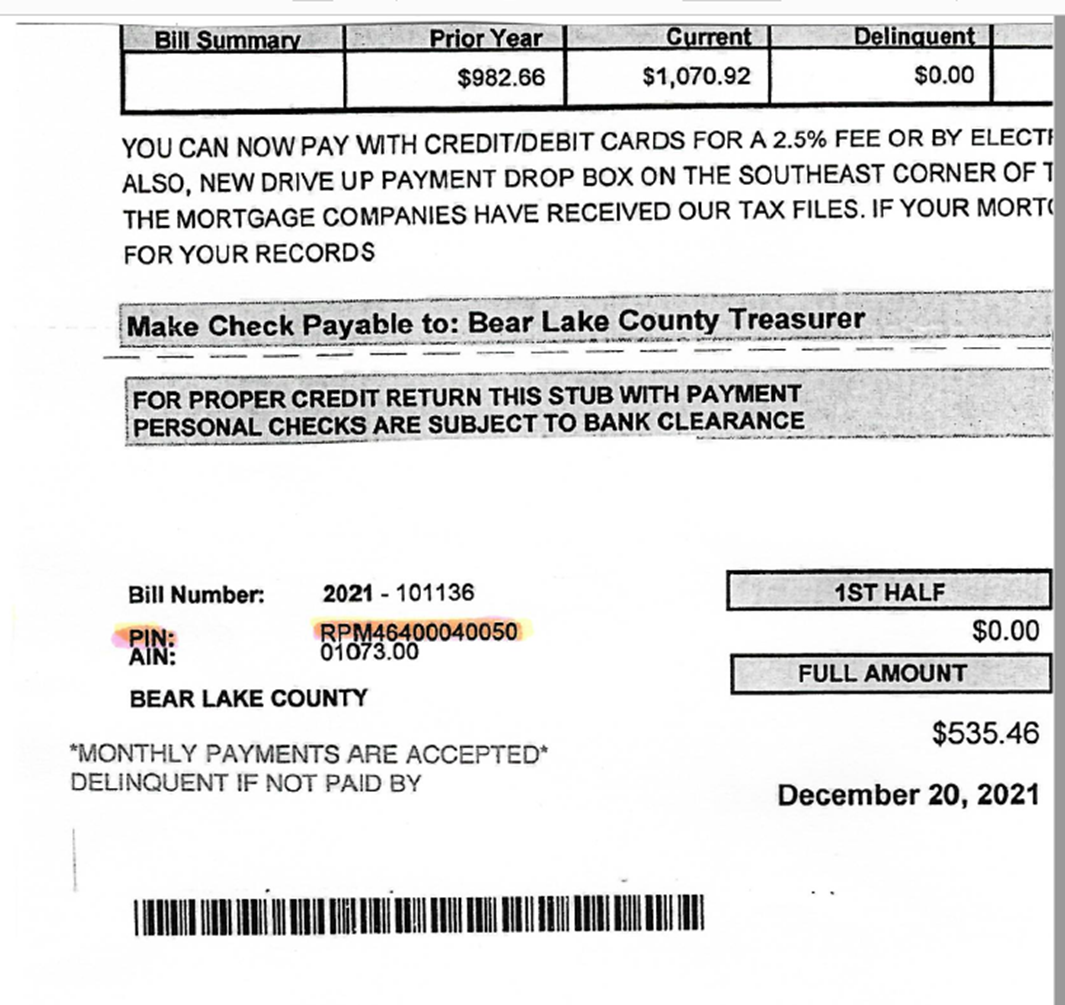

Bear Lake County Treasurer Bear Lake County Idaho

Sales Tax Calculator And Rate Lookup 2021 Wise

The Numbers Who Gets Rebates Tax Cuts Under House Bill Local News Idahopress Com

Idaho Sales Tax Rate Rates Calculator Avalara

Sales Tax Calculator And Rate Lookup Tool Avalara

State Local Sales Tax Rates 2020 Sales Tax Rates Tax Foundation